单选题According to the affective-filter hypothesis, _________is NOT an affective factor influencing language learning.A attitudeB motivationC interestD intelligence

题目

attitude

motivation

interest

intelligence

相似问题和答案

第1题:

A.description-oriented

B.experimental research

C.action research

D.deductive

第2题:

B.Completion with multiple choices.

C.Completion according to topic sentences.

D.Completion according to the brainstorming.

名师如何巧解题?查看视频解析>>

第3题:

(b) Explain the meaning of the term ‘Efficient Market Hypothesis’ and discuss the implications for a company if

the stock market on which it is listed has been found to be semi-strong form. efficient. (9 marks)

(b) The term ‘Efficient Market Hypothesis’ (EMH) refers to the view that share prices fully and fairly reflect all relevant available

information1. There are other kinds of capital market efficiency, such as operational efficiency (meaning that transaction costs

are low enough not to discourage investors from buying and selling shares), but it is pricing efficiency that is especially

important in financial management.

Research has been carried out to discover whether capital markets are weak form. efficient (share prices reflect all past or

historic information), semi-strong form. efficient (share prices reflect all publicly available information, including past

information), or strong form. efficient (share prices reflect all information, whether publicly available or not). This research has

shown that well-developed capital markets are weak form. efficient, so that it is not possible to generate abnormal profits by

studying and analysing past information, such as historic share price movements. This research has also shown that

well-developed capital markets are semi-strong form. efficient, so that it is not possible to generate abnormal profits by studying

publicly available information such as company financial statements or press releases. Capital markets are not strong form

efficient, since it is possible to use insider information to buy and sell shares for profit.

If a stock market has been found to be semi-strong form. efficient, it means that research has shown that share prices on the

market respond quickly and accurately to new information as it arrives on the market. The share price of a company quickly

responds if new information relating to that company is released. The share prices quoted on a stock exchange are therefore

always fair prices, reflecting all information about a company that is relevant to buying and selling. The share price will factor

in past company performance, expected company performance, the quality of the management team, the way the company

might respond to changes in the economic environment such as a rise in interest rate, and so on.

There are a number of implications for a company of its stock market being semi-strong form. efficient. If it is thinking about

acquiring another company, the market value of the potential target company will be a fair one, since there are no bargains

to be found in an efficient market as a result of shares being undervalued. The managers of the company should focus on

making decisions that increase shareholder wealth, since the market will recognise the good decisions they are making and

the share price will increase accordingly. Manipulating accounting information, such as ‘window dressing’ annual financial

statements, will not be effective, as the share price will reflect the underlying ‘fundamentals’ of the company’s business

operations and will be unresponsive to cosmetic changes. It has also been argued that, if a stock market is efficient, the timing

of new issues of equity will be immaterial, as the price paid for the new equity will always be a fair one.

第4题:

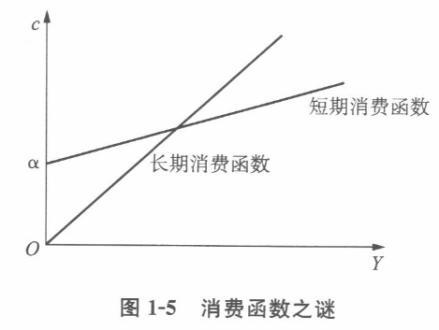

(1)一战后的经验数据表明,凯恩斯的绝对收入假说与现实经济运行情况并不吻合,实际中的消费函数如图1—5

所示。短期消费函数平均消费倾向下降,而长期消费函数平均消费倾向不变,这称为消费函数之谜。 (2)生命周期的消费理论由莫迪利安尼提出,该理论认为,人的理性消费是为了一生的效用最大化,强调人们会在更长时间范围内平稳他们的生活消费开支,以达到他们在整个生命周期内消费的最佳配置。按照该理论,消费不取决于现期收入,而主要取决于一生的收入。生命周期消费函数可用公式表示为

式中,W为实际财富;α为财富的边际消费倾向;Y为工作收入;β为工作收入的边际消费倾向。平均消费倾向为

从短期来看,人们的财富相对稳定,收入的增加不会带来财富的变化,因此随着收入的增加,平均消费倾向有下降的趋势;而从长期来看,人们的财富会随着收入的增加而同比例增加,因此随着收入的增加,W/Y 不变,平均消费倾向保持不变。这样,从长期来看,无数条具有正截距的短期消费曲线就构成了一条具有零截距的长期消费函数。

第5题:

B. submitted

C. certified

D. depended

第6题:

The work was done()her instructions.

A. according to

B. according with

C. accordance with

第7题:

第二篇

Night of the Living Ants

When an ant dies,other ants move the dead insect out of the nest.This behavior is interesting to scien-

tists,who wonder how ants know for sure一and so soon一that another ant is dead.

Dong-Hwan Choe,a scientist at the University of California,found that Argentine ants have a chemical

on the outside of their bodies that signals to other ants,"I'm dead一take me away."

But there's a twist to Choe's discovery. These ants behave a little bit like zombies(僵尸).Choe says

that the living ants一not just the dead ones一have this death chemicals. In other words,while an ant crawls

around,perhaps in a picnic or home,it's telling other ants that it's dead.

What keeps ants from hauling away the living dead? Choe found that Argentine ants have two additional

chemicals on their bodies,and these tell nearby ants something like,"Wait一I'm not dead yet."So Choe's

research turned up two sets of chemical signals in ants:one says,"I'm dead,"the other set says,"I'm not

dead yet."

Other scientists have tried to figure out how ants know when another ant is dead.If an ant is knocked

unconscious,other ants leave it alone until it wakes up.That means ants know that unmoving ants can still be

alive.

Choe suspects that when an Argentine ant dies,the chemical that says"Wait一I'm not dead yet"quickly

goes away. Once that chemical is gone,only the one that says"I'm dead"is left."It's because the dead ant

no longer smells like a living ant that it gets carried to the graveyard(墓地),not because its body releases

new,unique chemicals after death,"said Choe.When other ants detect the"dead"chemical without the"not

dead yet" chemical,they haul away the body. This was Choe's hypothesis(假设).

To test his hypothesis,Choe and his team put different chemicals on Argentine ant pupae(蛹).When

the scientists used the"I'm dead"chemical,other ants quickly hauled the treated pupae away.When the sci-

entists used the"Wait一I'm not dead yet"chemical,other ants left the treated pupae alone.Choe believes

this behavior shows that the" not dead yet" chemical overrides(优先于)the" dead" chemical when picked up

by adult ants.And that when an ant dies,the"not dead yet"chemical fades away.Other nearby ants then de-

tect the remaining"dead"chemical and remove the body from the nest.

A:It shows that his hypothesis is wrong.

B:It proves that his hypothesis is convincing.

C:It suggests that his hypothesis needs revising.

D:Not enough evidence has been found to support his hypothesis.

根据第五段第二句可推断出C项错误。

倒数第二段提到:一只阿根廷蚂蚁死后,发出“等等,我还没死呢”这一信号的化学物质 立刻消失,因此选D。

周的假设是表明“我死了”的化学物质是蚂蚁本身就有的,而非死后释放的。它和表明 “我没死”的化学物质同时存在于活着的蚂蚁身上,只不过其优先权不如表明“我没死”的化学 物质。实验结果是:当科学家用“我已死”化学物质时,蚂蚁们立刻将处理过的蛹拉走。当科 学家使用“等等,我还没死”化学物质时,其他蚂蚁并不碰这个蛹。所以,周的假设是正确的。

本文主要讲述了蚂蚁们如何迅速准确地得知同伴死了,所以选D。 第三篇 本文介绍了在山口发现的一具躺在冰上的尸体,以及由此引发的研究和种种猜测。

第8题:

有效市场假说(Efficient markets hypothesis)

根据这一假设,投资者在买卖股票时会迅速有效地利用可能的信息.所有已知的影响一种股票价格的因素都已经反映在股票的价格中,因此根据这一理论,股票的技术分析是无效的。(这个假设有三种形式。)

第9题:

B. nervous

C. immune

D. physical

第10题:

B.In accordance with

C.To

D.In according to