By the end of last year, nearly a million cars __________in that auto factory.A.had produced B.had been produced C.would be produced D.were produced

题目

B.had been produced

C.would be produced

D.were produced

相似问题和答案

第1题:

A.had already learnt

B.have already learnt

C.would have already learnt

D.already learnt

第2题:

A. 这里有今年和去年5百万美元的销售额差价。

B. 今年和去年的销售额相差5百万美元。

C. 今年和去年的销售额有5百万美元的不同。

第3题:

A.in end

B.on end

C.at end

D.by end

第4题:

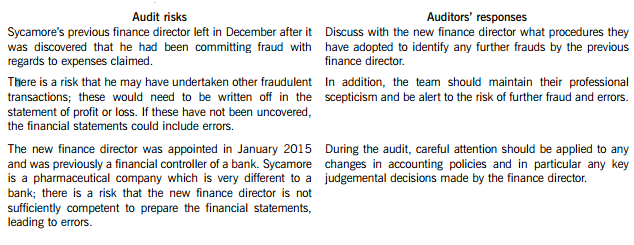

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

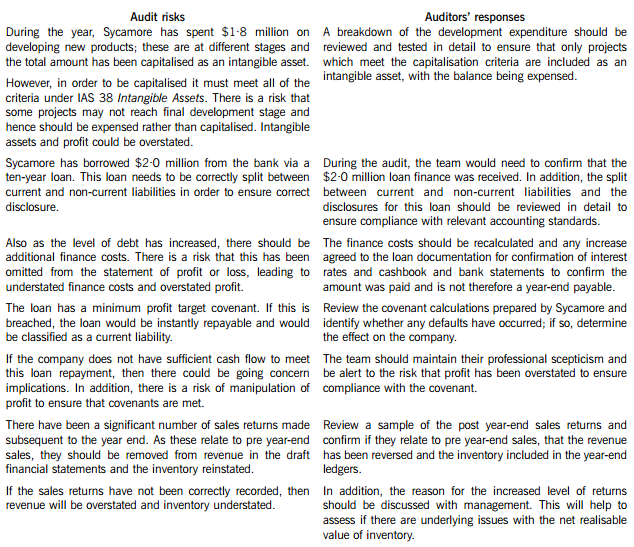

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

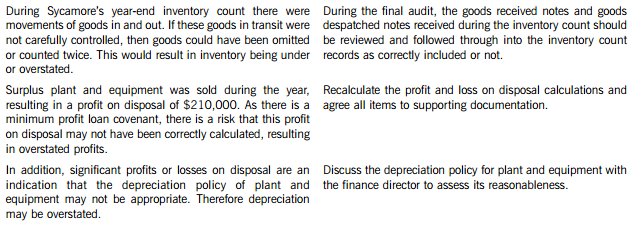

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

第5题:

阅读短文,判断句子正误,正确的写T,错误的写F 。

In recent years, the Chinese auto industry has seen rapid growth, with the demand on private cars rising sharply in Chinese cities since 2002.

By 2009, China has replaced the U.S. to become the world's largest auto market. As an important part of the world car industry, the global auto industry will shift further to China. This brings historical opportunity to China's auto market.

Currently, both the development of China's auto market and the changes in consumer demand for vehicles are ever -increasing. China's auto industry will continue to grow in the next decade. It means there is still huge room for its development. China has an urban population of more than 600million. It also has a huge agricultural vehicle market in the rural areas. Hence, there is no doubt for China's development of auto industry. That is also the reason why the world's auto producers are paying more attention to the Chinese market.

()26. The demand on private cars increased greatly in Chinese cities since 2002.

()27. China has become the world's largest auto market.

()28. China's auto industry tends to decrease in the next decade.

()29. China has an urban population of less than 600 million.

()30. The reason why the world's auto producers are paying more attention to the Chinese market is that China's auto industry developed very quickly.

参考答案:26-30:T T F F F

第6题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation.

第7题:

By the end of last year they _____ 1,000 machines.

A. turned out

B. had turned out

C. would turn out

D. had been turned out

第8题:

A. high as last year

B. high as last year's

C. as high as last year's

D. as high as last year

第9题:

By the end of last year China’s foreign reserves ____ $4 trillion.

A: have reached

B: had reached

C: reached

D: would reach

第10题:

Estimates _____ anywhere from 600 000 to 3 million. Although the figure may vary, analysts do agree on another mater: that the number of the homeless is increasing. One of the federal government’s studies predicts that the number of the homeless will reach nearly 19 million by the end of this decade.

[A] cover

[B] change

[C] differ

[D] range

16. [D] 本句意思为“估计数字的范围大约从60万到300 万之间”,而 range from… to …这一句型正是表示“在……范围之内变化”的意思,故本题选[D]。[A] cover 虽然有“包含”之意,但 cover表示“覆盖”的面积、大小,不表示范围,故排除。[C] differ 主要强调不同,而本句并未强调不同,只是强调范围,故选择 range。