单选题Assume your situation can be described as follows: x A full backup taken using RMAN is available on disk. x The current control files were NOT damaged and do not need to be restored. x All data files are damaged or lost. x The database is in NOARCHI

题目

RECOVER DATABASE;

SWITCH DATAFILE ALL;

RESTORE CONTROL FILE;

RECOVER DATABASE USING BACKUP CONTROL FILE;

相似问题和答案

第1题:

(ii) Write a letter to Donald advising him on the most tax efficient manner in which he can relieve the loss

incurred in the year to 31 March 2007. Your letter should briefly outline the types of loss relief available

and explain their relative merits in Donald’s situation. Assume that Donald will have no source of income

other than the business in the year of assessment 2006/07 and that any income he earned on a parttime

basis while at university was always less than his annual personal allowance. (9 marks)

Assume that the corporation tax rates and allowances for the financial year 2004 and the income tax rates

and allowances for 2004/05 apply throughout this question.

Relevant retail price index figures are:

January 1998 159·5

April 1998 162·6

(ii) [Donald’s address] [Firm’s address]

Dear Donald [Date]

I understand that you have incurred a tax loss in your first year of trading. The following options are available in respect

of this loss.

1. The first option is to use the trading loss against other forms of income in the same year. If such a claim is made,

losses are offset against income before personal allowances.

Any excess loss can still be offset against capital gains of the year. However, any offset against capital gains is

before both taper relief and annual exemptions.

第2题:

CDMA for cellular system can be described as follows. As with FDMA, each cell is allocated a frequency (71) , when is split into two parts, half for reverse (mobile unit to base station) and half for (72) (base station to mobile unit). For full-duplex (73) , a mobile unit both reverse and forward channels. Transmission is in the form. of direct-sequence spread (74) , which used a chipping code to increase the data rate of the transmission, resulting is an increased signal bandwidth. Multiple access is provided by assigning (75) chipping codes to multiple users, so that the receiver can recover the transmission of an individual unit from multiple transmissions.

A.ware

B.signal

C.bandwidth

D.domain

用于蜂窝系统的CDMA技术可以描述如下。就像FDMA一样,每一个小区被分配了一个频带,该频带划分为两半,一半用于反向信道(从移动终端到基站),一半用于正向信道(从基站到移动终端)。在全双工通信中,移动终端使用了反向和正向两个信道。传输以直接序列扩频方式进行,用一个码片来增加传输的数据速率,同时也产生了额外的信号带宽。通过把正交的各个码片指定给不同的用户就可以实现多路访问,这样接收者就能够从多个传输中提取并恢复需要的传输单元。

第3题:

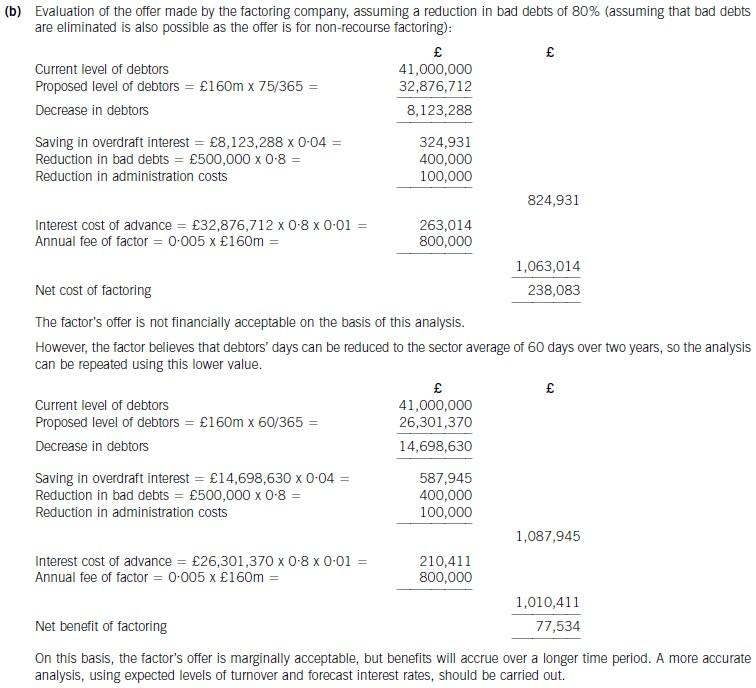

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

第4题:

B.It is used to show that one is enthusiastic and hospitable

C.It is used to create a more friendly atmosphere and to avoid embarrassment

D.It is used by people to protect others in the threatening situation

第5题:

B.Generalization.

C.Collocation.

D.Contextualization.

该教师在词汇教学中创造情境,让学生了解词汇在具体情境下的使用,意在训练学生在情境中学习词汇的学习方法,故此题的正确选项为D

A项为“联系;联想”;B项为“归纳;普通化”;C项为“搭配”;均不合题意,故排除。

故此题的正确选项为D。

第6题:

May I ask your full name?

第7题:

Your ISP assigned you a full class B address space. From this, you need at least 300 sub-networks that can support at least 50 hosts each. Which of the subnet masksbelow are capable of satisfying your needs?()

A.255.255.255.0

B.255.255.255.128

C.255.255.252.0

D.255.255.255.224

E.255.255.255.192

F.255.255.248.0

第8题:

Assume that the corporation tax rates for the financial year 2004 apply throughout.

(b) Explain the corporation tax (CT) and value added tax (VAT) issues that Irroy should be aware of, if she

proceeds with her proposal for the Irish subsidiary, Green Limited. Your answer should clearly identify those

factors which will determine whether or not Green Limited is considered UK resident or Irish resident and

the tax implications of each alternative situation.

You need not repeat points that are common to each situation. (16 marks)

(b) There are several matters that Irroy will need to be aware of in relation to value added tax and corporation tax. These are set

out below.

Residence of subsidiary

Irroy will want to ensure that the subsidiary is treated as being resident in the Republic of Ireland. It will then pay corporation

tax on its profits at lower rates than in the UK. The country of incorporation usually claims taxing rights, but this is not by

itself sufficient. Irroy needs to be aware that a company can be treated as UK resident by virtue of the location of its central

management and control. This is usually defined as being where the board of directors meets to make strategic decisions. As

a result, Irroy needs to ensure that board meetings are conducted outside the UK.

If Green Limited is treated as being UK resident, it will be taxed in the UK on its worldwide income, including that arising in

the Republic of Ireland. However, as it will be conducting trading activities in the Republic of Ireland, Green Limited will also

be treated as being Irish resident as its activities in that country are likely to constitute a permanent establishment. Thus it

may also suffer tax in the Republic of Ireland as a consequence, although double tax relief will be available (see later).

A permanent establishment is broadly defined as a fixed place of business through which a business is wholly or partly carried

on. Examples of a permanent establishment include an office, factory or workshop, although certain activities (such as storage

or ancillary activities) can be excluded from the definition.

If Green Limited is treated as being an Irish resident company, any dividends paid to Aqua Limited will be taxed under

Schedule D Case V in the UK. Despite being non resident, Green Limited will still count as an associate of the existing UK

companies, and may affect the rates of tax paid by Aqua Limited and Aria Limited in the UK. However, as a non UK resident

company, Green Limited will not be able to claim losses from the UK companies by way of group relief.

Double tax relief

If Green Limited is treated as UK resident, corporation tax at UK rates will be payable on all profits earned. However, income

arising in the Republic of Ireland is likely to have been taxed in that country also by virtue of having a permanent

establishment located there. As the same profits have been taxed twice, double tax relief is available, either by reference to

the tax treaty between the UK and the Republic of Ireland, or on a unilateral basis, where the UK will give relief for the foreign

tax suffered.

If Green Limited is treated as an Irish resident company, it will pay tax in the Republic of Ireland, based on its worldwide

taxable profits. However, any repatriation of profits to the UK by dividend will be taxed on a receipts basis in the UK. Again,

double tax relief will be available as set out above.

Double tax relief is available against two types of tax. For payments made by Green Limited to Aqua Limited on which

withholding tax has been levied, credit will be given for the tax withheld. In addition, relief is available for the underlying tax

where a dividend is received from a foreign company in which Aqua Limited owns at least 10% of the voting power. The

underlying tax is the tax attributable to the relevant profits from which the dividend was paid.

Double tax relief is given at the lower rate of the UK tax and the foreign tax (withholding and underlying taxes) suffered.

Transfer pricing

Where groups have subsidiaries in other countries, they may be tempted to divert profits to subsidiaries which pay tax at lower

rates. This can be achieved by artificially changing the prices charged (known as the transfer price) between the group

companies. While they can do this commercially through common control, anti avoidance legislation seeks to correct this by

ensuring that for taxation purposes, profits on such intra-group transactions are calculated as if the transactions were carried

out on an arms length basis. Since 1 April 2004, this legislation can also be applied to transactions between UK group

companies.

If Green Limited is treated as a UK resident company, the group’s status as a small or medium sized enterprise means that

transfer pricing issues will not apply to transactions between Green Limited and the other UK group companies.

If Green Limited is an Irish resident company, transfer pricing issues will not apply to transactions between Green Ltd and the

UK resident companies because of the group’s status as a small or medium-sized enterprise and the existence of a double

tax treaty, based on the OECD model, between the UK and the Republic of Ireland.

Controlled foreign companies

Tax legislation exists to stop a UK company accumulating profits in a foreign subsidiary which is subject to a low tax rate.

Such a subsidiary is referred to as a controlled foreign company (CFC), and exists where:

(1) the company is resident outside the UK, and

(2) is controlled by a UK resident entity or persons, and

(3) pays a ‘lower level of tax’ in its country of residence.

A lower level of tax is taken to be less than 75% of the tax that would have been payable had the company been UK resident.

If Green Limited is an Irish resident company, it will be paying corporation tax at 12·5% so would appear to be caught by

the above rules and is therefore likely to be treated as a CFC.

Where a company is treated as a CFC, its profits are apportioned to UK resident companies entitled to at least 25% of its

profits. For Aqua Limited, which would own 100% of the shares in Green Limited, any profits made by Green Limited would

be apportioned to Aqua Limited as a deemed distribution. Aqua Limited would be required to self-assess this apportionment

on its tax return and pay UK tax on the deemed distribution (with credit being given for the Irish tax suffered).

There are some exemptions which if applicable the CFC legislation does not apply and no apportionments of profits will be

made. These include where chargeable profits of the CFC do not exceed £50,000 in an accounting period, or where the CFC

follows an acceptable distribution policy (distributing at least 90% of its chargeable profits within 18 months of the relevant

period).

Value added tax (VAT)

Green Limited will be making taxable supplies in the Republic of Ireland and thus (subject to exceeding the Irish registration

limit) liable to register for VAT there. If Green Limited is registered for VAT in the Republic of Ireland, then supplies of goods

made from the UK will be zero rated. VAT on the goods will be levied in the Republic of Ireland at a rate of 21%. Aqua Limited

will need to have proof of supply in order to apply the zero rate, and will have to issue an invoice showing Green Limited’s

Irish VAT registration number as well as its own. In the absence of such evidence/registration, Aqua Limited will have to treat

its transactions with Green Limited as domestic sales and levy VAT at the UK standard rate of 17·5%.

In addition to making its normal VAT returns, Aqua Limited will also be required to complete an EU Sales List (ESL) statement

each quarter. This provides details of the sales made to customers in the return period – in this case, Green Limited. Penalties

can be applied for inaccuracies or non-compliance.

第9题:

B.stable

C.suitable

D.adaptable

第10题:

B. stable

C.suitable

D.adaptable